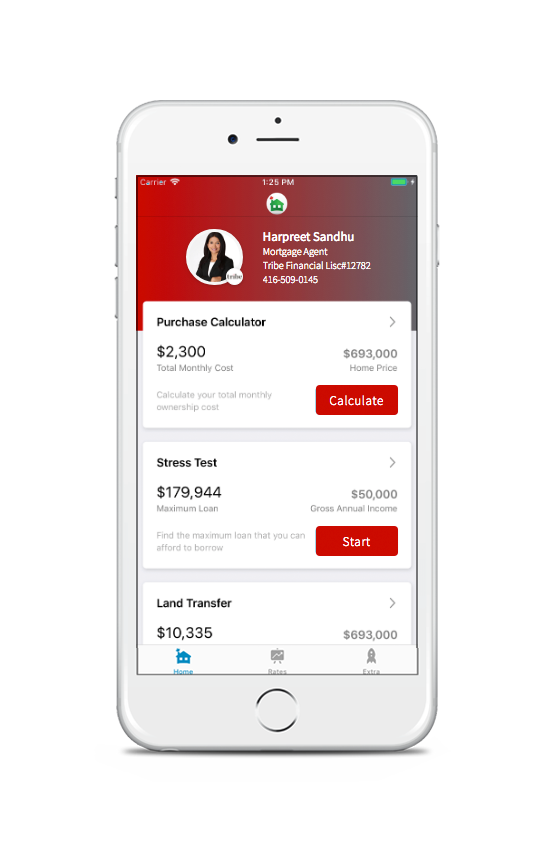

Harpreet Sandhu

Mortgage Agent – Level 2

There’s strength in numbers.

Confidence, too. And the confidence that comes with having the numbers on your side starts with having the right people on your side. People who speak numbers, speak your language and whose reputations speak for themselves. People who understand your goals and work with you to meet them. People like you. For trusted financial advice and service that makes you feel like you belong.

Join the tribe.

Mortgage

Services.

Customer Care

I believe that my responsibility as a mortgage expert goes well beyond simply arranging your mortgage financing. My job is to ensure that you feel confident in the mortgage process and make decisions that best suit you and your tribe.

Education

In order for you to feel confident about the mortgage process and make the best decisions for your tribe, you have to feel at ease and be able to ask questions. I stay in touch with you throughout the entire process, provide information up front, but also make myself available whenever you need me!

Best Mortgage Products

Being a part of the tribe has advantages. Access to the best lender products available anywhere in Canada is one of them. We use our extensive corporate networks to ensure you get the best mortgage product. It pays to belong.

Lenders.

We have developed excellent relationships with several lenders, let’s figure out which one has the best products to offer you!

10 Tips for Saving Your Down Payment on a Home

Saving for a down payment on a home can be challenging but, with careful planning and discipline, this important milestone will become much more easily achievable. Following are 10 helpful tips to get you started on your homeownership journey as soon as possible. 1....

read more

Have You Thought About Buying a Place for Your Post-Secondary Children?

College and university residence spaces and local rental opportunities are tight in many areas with concentrated amounts of student population. That’s why it may be a great idea to consider buying a home for your child and their friends/roommates to live in while...

read more

How Does a Private Mortgage Compare to a Traditional Mortgage?

Private mortgage options have become increasingly more popular thanks to stringent stress test mortgage qualification rules required by traditional lenders such as banks, increased inflation and higher interest rates. It’s just one more option your mortgage agent can...

read more